What Does Paul B Insurance Mean?

Table of ContentsExcitement About Paul B InsuranceSome Known Questions About Paul B Insurance.7 Simple Techniques For Paul B InsuranceWhat Does Paul B Insurance Do?6 Easy Facts About Paul B Insurance ShownPaul B Insurance - An Overview

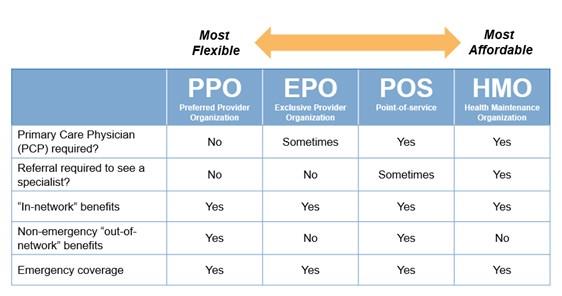

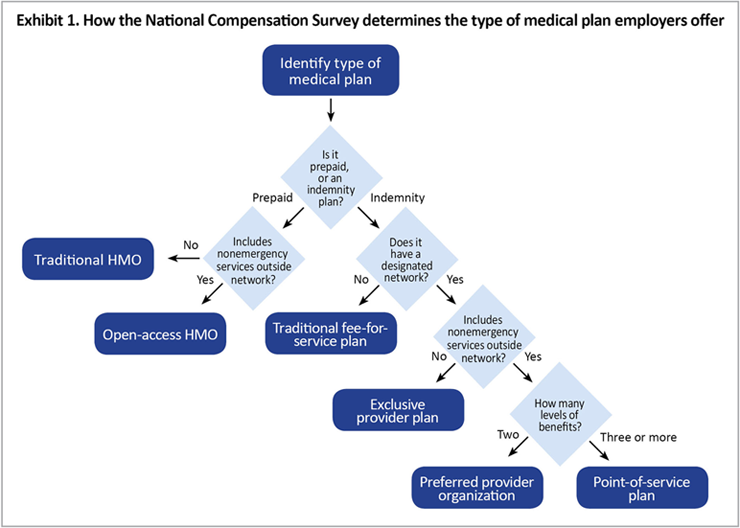

An HMO might need you to live or operate in its solution location to be qualified for protection. HMOs frequently offer incorporated care as well as concentrate on avoidance as well as health. A kind of plan where you pay much less if you utilize medical professionals, healthcare facilities, and other wellness care service providers that belong to the strategy's network.

A kind of health insurance plan where you pay much less if you make use of service providers in the strategy's network. You can make use of physicians, healthcare facilities, and also suppliers outside of the network without a referral for an additional cost.

You have choices when you look for medical insurance. If you're purchasing from your state's Marketplace or from an insurance policy broker, you'll select from health strategies arranged by the level of advantages they offer: bronze, silver, gold, as well as platinum. Bronze plans have the least protection, and also platinum strategies have one of the most.

Any in your HMO's network. If you see a physician that is not in the network, you'll might need to pay the full expense yourself. Emergency solutions at an out-of-network hospital need to be covered at in-network rates, however non-participating medical professionals that treat you in the hospital can bill you. This is the price you pay each month for insurance coverage.

Our Paul B Insurance Statements

A copay is a flat charge, such as $15, that you pay when you obtain care. These costs differ according to your strategy as well as they are counted towards your deductible.

Greater out-of-pocket costs if you see out-of-network doctors vs. in-network providers, Even more documents than with other plans if you see out-of-network companies Any type of in the PPO's network; you can see out-of-network physicians, but you'll pay even more. This is the cost you pay monthly for insurance policy. Some PPOs might have a deductible.

A copay is a level cost, such as $15, that you pay when you obtain treatment. Coinsurance is when you pay a percent of the fees for care, as an example 20%. If your out-of-network physician bills greater than others in the location do, you might have to pay the equilibrium after your insurance pays its share.

This is the price you pay each month for insurance. A copay is a flat cost, such as $15, that you pay when you get care.

The Greatest Guide To Paul B Insurance

This is the expense you pay monthly for insurance policy. Your strategy might require you to pay the amount of an insurance deductible before it covers care past precautionary services. You may pay a greater deductible if you see an out-of-network copyright. You will pay either a copay, such as $15, when you get treatment or coinsurance, which is a percent of the fees for treatment.

We can not avoid the unanticipated from happening, but often we can safeguard ourselves and our family members from the most awful of the monetary results. Picking the ideal type and amount of insurance policy is based on your particular scenario, such as children, age, way of life, as well as employment benefits. Four kinds of insurance coverage that most financial experts suggest consist of life, wellness, auto, and also long-lasting disability.

It consists of a fatality advantage and additionally a money value part.

2% of the American population lacked insurance protection in 2021, the Centers for Illness Control (CDC) reported in its National Center for Wellness Stats. Greater than 60% obtained their coverage with an employer or in the exclusive insurance policy marketplace while the remainder were covered by government-subsidized programs including Medicare and also Medicaid, professionals' benefits programs, and also the federal industry established under the Affordable Treatment Act.

Indicators on Paul B Insurance You Need To Know

According to the Social Safety and security Management, one in four employees going into the labor force will end up being impaired prior to they reach the age of retired life. While health and wellness insurance policy pays for hospitalization as well as clinical bills, you are often strained with all of the costs that your income had covered.

Nearly all states need motorists to have vehicle insurance and minority that do not still hold vehicle drivers financially in charge of any type of damage or injuries they trigger. Right here are your choices when acquiring car insurance: Liability coverage: Pays for residential property damages and injuries you create to others if you're at fault for a crash and likewise covers litigation costs as well as judgments or settlements if you're sued due to an auto crash.

Company insurance coverage is usually the most effective choice, but if that is unavailable, obtain quotes from numerous companies as many give discounts if you buy greater than one kind of insurance coverage.

The Ultimate Guide To Paul B Insurance

When contrasting plans, there are a couple of aspects you'll want to take into consideration: network, expense and also benefits. Look at each strategy's network and also establish if your preferred companies are in-network. If your doctor is not in-network with a strategy you are considering yet you intend click for more to proceed to see them, you might intend to think about a various plan.

Look for the one that has one of the most advantages as well as any specific medical professionals you need. The majority of employers have open registration in the fall of yearly. visite site Open registration is when you can transform your benefit selections. You can change health and wellness strategies if your employer provides even more than one strategy.

You will certainly have to pay the premiums yourself. ; it might cost less than specific health and wellness insurance coverage, which is insurance coverage that you purchase on your own, as well as the benefits may be better. If you qualify for Federal COBRA or Cal-COBRA, you can not be rejected protection as a result of a clinical problem.

Excitement About Paul B Insurance

Some HMOs provide look at this web-site a POS plan. If your copyright refers you beyond the HMO network, your costs are covered. If you refer on your own beyond the HMO network, your insurance coverage may be denied or coinsurance required. Fee-for-Service plans are commonly taken typical strategies. You can acquire the strategy, and afterwards you can see any kind of medical professional at any kind of center.